Profitability, Funding, and

Benefit Strategists

Experience Matters.

Let us help you gain access to what is rightfully yours.

Recovery Profitability

We can help lower your current print/copy equipment lease costs by 30-60% on average in this one area alone. We've saved our clients millions of dollars and seen over $240MM in hardware contracts influenced over the last 10 years. There are millions more hiding and we can help you recover your share. You pay zero-up front and zero out-of-pocket for our help. We only get paid when we successfully recover for you the tax credits, medical underpayments, grants, or other funding sources waiting for you.

Self-Employed Tax Credit

Self-Employed Tax Credit

Did you have self-employed income in either 2020 or 2021. Were you a 1099 independent contractor during this time period? If so, you may qualify for the remarkable Self-Employment Tax Credit (SETC).

Qualify and you could receive up to

$32,220.

There's zero up-front or out-of-pocket cost to you to apply for this generous tax credit. You keep 80% of whatever we can get for you and our team of Tier 1 tax credit recovery accountants keep the remaining 20%. (We personally receive a small finder's fee; most of it goes to the accountants). This program only lasts until April 15th, 2025 so don't delay. Click here to apply today.

How Does It Work?

The Families First Coronavirus Response Act (FFCRA), as amended by the Tax Relief Act of 2020, is intended to help United States Citizens recover from COVID-19 by providing small businesses refundable tax credits that reimburse them, dollar-for-dollar, for the cost of providing paid sick and family leave wages to their employees for leave related to COVID-19. The FFCRA extends to self-employed individuals equivalent refundable tax credits against their personal net income tax.

To request assistance with any of these areas, please reach out to whomever introduced you to Certainty Management, call us toll free at (888) 684-3122, or schedule a time to meet with us at your convenience by clicking here.

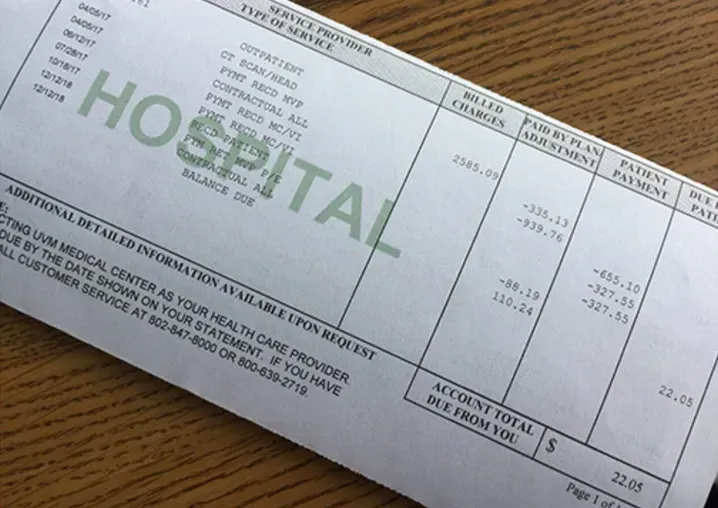

Medical Underpayment Audit

If you're a hospital or surgical center, there's a very good chance that you're owed additional money on your "zero sum" accounts, and we know how to recover it for you. We offer a free paid and denied account medical underpayment review that can result in millions more recovered from the insurance providers. We only get paid when it works. We have helped 100% of our clients in this space recover more (average recovery = 10-20%).

Button

Button

How Can We Serve You Best Today?

Button

Button

Button

Button

Listen in to Finding Certainty with Patrick Laing on VoiceAmerica Business, Fridays from 9-10 am Pacific. Listen to BizZne$$ BuzZ with Frank Helring on Wednesdays from 10-11 am Pacific. Find both shows after the live shows have aired on most top broadcast channels: Audible, iHeartRadio, Apple and Google, and more.

Listen to Finding Certainty at

www.certaintylive.com

Contact Us

Monday-Friday 9-5 (Pacific)

Visit Us

2831 St. Rose Parkway, Suite 200

Henderson NV 89052 USA

All Rights Reserved • Certainty Management

Investment Advice: the Company’s Services are for informational purposes only and do not constitute legal, tax, investment, financial, or other professional advice. We do not solicit, recommend, endorse, or offer to buy or sell securities, currencies, or financial instruments. All content provided is general in nature and may not address your specific circumstances. None of the information provided constitutes professional or financial advice. The Company is not your fiduciary.